In the fast-paced private equity world, staying ahead of the competition is paramount. Our client, a prominent investment firm managing over $70 Billion in assets, was facing a unique set of challenges. They needed a game-changing solution to detect promising investment prospects before their competitors could make a move. This is how our client partnered with us to transform their strategy.

Challenge: The Quest for a Competitive Edge

The client faced a challenge that resonated with many in the investment world: identify suitable prospects for capital investment before the competition. The client’s competition was fierce, and they could not afford to rely solely on historical data and traditional methods. They needed a partner who could offer not only insights but also a strong strategy and execution plan focused on portfolio companies and fund analysis.

The client encountered a significant challenge as there was no single platform available that could provide them with complete insights. Due to the absence of such a tool, it became difficult for them to make informed decisions and plan strategically. Although there were many prescriptive tools available in the market, the client was searching for something beyond that – predictive capabilities backed by artificial intelligence (AI).

Aeries’ Solution: Turning Data into Opportunity

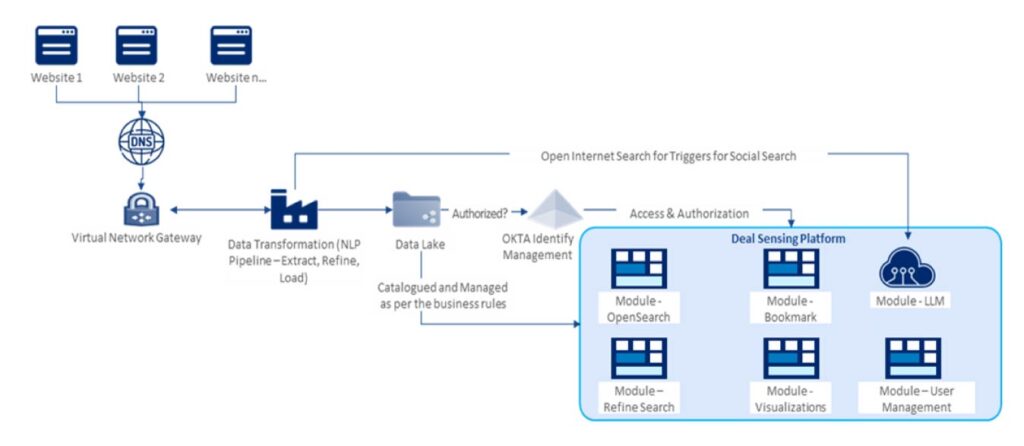

The client found in Aeries a partner committed to their success. Aeries embarked on a journey to harness the power of data and AI to transform the client’s investment strategy. Aeries Research and Innovation (ARI) team worked closely with the client to develop a bespoke Deal Sensing Platform to assist them in achieving speed and quality in investment decisions.

The platform implemented the following steps.

- Market Scanning: The Deal Sensing Platform initiated its process by scanning the market. This scanning involved the analysis of various market factors, such as industry trends, financial performance, growth potential, and strategic alignment. By applying these predefined criteria, the platform sifted through a large pool of options, allowing it to pinpoint companies that met the initial qualifications for potential investment or partnerships.

- Enabled Human-like Inference: With its advanced capabilities enabling human-like inference, it made decisions on behalf of a human regarding which firms to share with the deal team. Leveraging data-driven insights and predefined criteria, it autonomously identified and recommended potential companies. In addition, the tools could also analyze and make sense of data posted by the target companies on social media, press releases, etc.

- Enhanced Natural Language Processing (NLP) Pipeline: Aeries team incorporated NLP into the client’s data pipeline to enhance efficiency and enable better-informed decision-making. The primary goal was to simplify the collection, processing, and organization of reports for end-users. This resulted in more accessible and informative reports for end-users.

- Database Creation, Filtering and Historic Data: This helped the client in two ways.

- The platform harnessed existing aggregation, industry grouping, and target company filtering to swiftly detect promising investment opportunities.

- This resulted in the creation of a database for the Deal team to identify companies using preset keywords and filters, with data-saving capabilities for generating comparison reports.

- Intelligent AI Automation Workflow: Aeries implemented intelligent AI Automation that enabled data-driven decisions by adapting to changing conditions and performing tasks with a level of intelligence and autonomy.

- Summarized Intelligent Report: The Deal Sensing tool used intelligent AI to provide concise yet comprehensive details about targeted portfolio companies and their financials, highlighting the top keywords and filters applied by the deal search team.

- Implemented leading technology and methodologies: Aeries harnessed the power of technologies such as large language models (LLM) and natural language processing (NLP) pipelines. Aeries also employed agile methodologies and design thinking principles to achieve outstanding results for the client. Additionally, Aeries’ seamless API integrations played a pivotal role in the client’s success.

Outcomes: A New Era of Investment Success

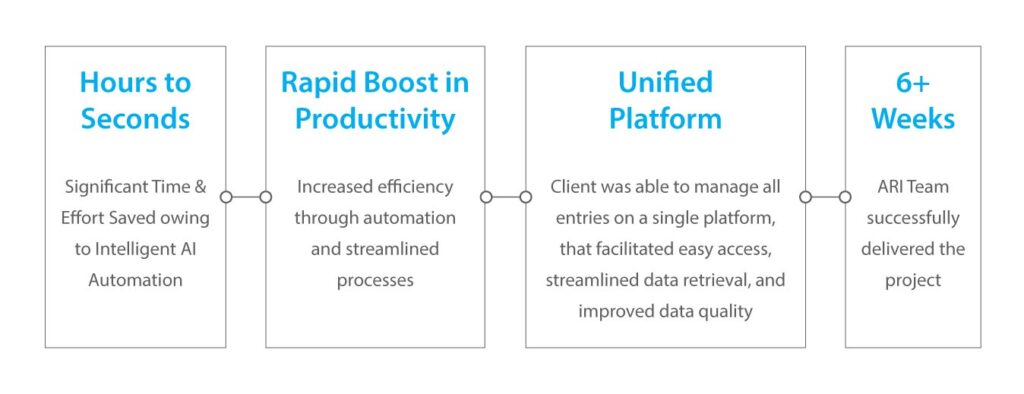

Incorporating this cutting-edge tool into the deal-sourcing strategy brought about remarkable outcomes for the client.

Conclusion: Redefining Investment Strategies

Our client’s journey is a testament to the transformative power of data and predictive analytics in the private equity industry. By partnering with Aeries to overcome their challenges, the client redefined their investment strategies and paved the way for sustained success in a highly competitive landscape.

This serves as a reminder that in the digital age, the ability to predict and adapt is critical to maintaining a competitive edge across all industries.

Discover how AI in finance and accounting is reshaping investment strategies and setting new standards of excellence in the private equity industry.